Are you curious about how credit scores impact your financial opportunities? In the article “Understanding the Basics of Credit Scores,” you will delve into the world of credit scores and gain an understanding of their importance. From learning about credit scoring models like FICO and VantageScore, to discovering the range of credit scores and how lenders view them, this article will equip you with the knowledge to navigate the world of credit. You will also uncover where to find your credit score, the significance of monitoring it regularly, and the role of financial coaches in credit monitoring. By the end of the article, you will have a comprehensive recap of key points and be eagerly anticipating the upcoming blogs in the series. So get ready to unlock the secrets of credit scores and pave the way towards financial success! You may have heard the term before, but do you really understand what credit scores are and why they matter? In this article, we will explore the impact of credit scores on financial opportunities and borrowing rates. We will also dive into the details of credit scoring models, how credit scores are calculated, and the range of credit scores. Additionally, we will discuss where to find your credit score, the importance of monitoring it regularly, and the role of financial coaches in credit monitoring. So, let’s get started and demystify the world of credit scores!

Recap of Key Points

- Credit scores are numerical values used by lenders to assess an individual’s creditworthiness.

- FICO and VantageScore are popular credit scoring models.

- Credit scores take into account factors such as payment history, credit utilization, length of credit history, credit mix, and new credit.

- Credit scores can fall into ranges, including poor, fair, good, and excellent, indicating different levels of creditworthiness.

- Knowing your credit score is important to understand your eligibility for financial opportunities and to monitor your credit health.

- Lenders view different credit ranges differently, with higher credit scores resulting in more favorable loan terms.

- Obtain your free credit report from Equifax, Experian, and TransUnion to find your credit score and review your credit history.

- Regularly monitoring your credit score helps you stay aware of any changes and detect potential errors or fraudulent activity.

- Financial coaches can provide guidance on credit monitoring and help improve your creditworthiness.

- Set up credit score alerts to receive notifications about significant changes to your credit score.

What Are Credit Scores?

Definition of Credit Scores

Credit scores are numerical values that represent an individual’s creditworthiness. They are primarily used by lenders to assess the likelihood of a borrower repaying their debts on time. In other words, credit scores help lenders determine the level of risk associated with lending money to someone.

Credit Scoring Models (FICO, VantageScore)

There are various credit scoring models used by lenders, but the most commonly used ones are FICO and VantageScore. FICO scores, developed by the Fair Isaac Corporation, are widely used in the United States and range from 300 to 850. VantageScore, on the other hand, is a credit scoring model developed by the three major credit bureaus – Equifax, Experian, and TransUnion – and also ranges from 300 to 850.

How Credit Scores Are Calculated

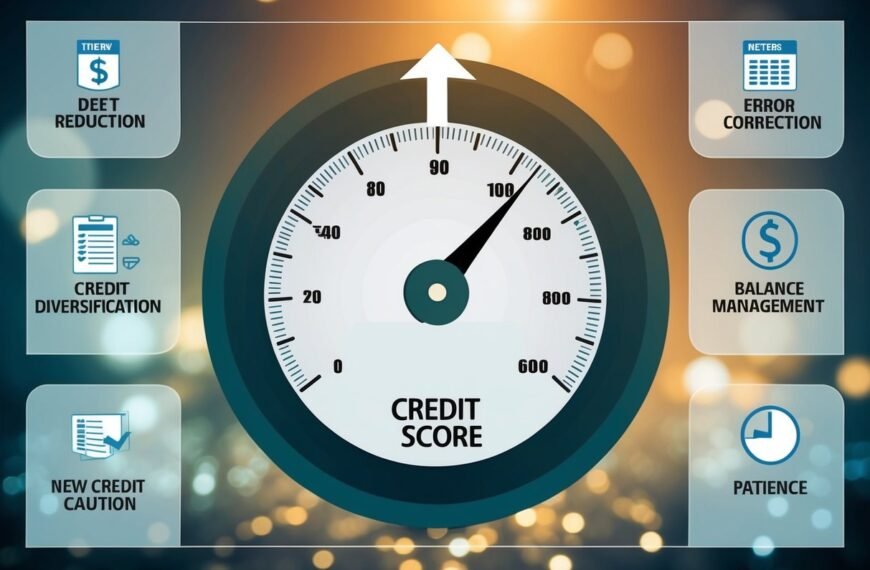

While the exact formulas used to calculate credit scores are closely guarded secrets, there are common factors that influence credit scores. These factors typically include payment history, credit utilization, length of credit history, credit mix, and new credit. Payment history, which reflects whether you have paid your bills on time, usually carries the most weight in the calculation.

The Range of Credit Scores

Credit Score Ranges (Poor, Fair, Good, Excellent)

Credit scores can fall into different ranges, with each range indicating a different level of creditworthiness. The specific ranges can vary slightly depending on the credit scoring model being used, but generally, they can be categorized as poor, fair, good, and excellent.

A poor credit score is typically below 580, and it may make it challenging to obtain credit or be subject to higher interest rates. Fair credit scores usually range from 580 to 669 and may still result in higher interest rates. Good credit scores, falling between 670 and 739, put borrowers in a more favorable position to qualify for loans and receive lower interest rates. Excellent credit scores, which typically range from 740 to 850, come with the best terms and rates available.

Importance of Knowing Your Credit Score

Knowing your credit score is crucial because it helps you understand how lenders view your creditworthiness. By understanding your credit score, you can gauge your eligibility for various financial opportunities, such as getting approved for loans or obtaining credit cards. Additionally, monitoring your credit score allows you to identify any potential errors or fraudulent activity that may negatively impact your credit standing.

How Lenders View Different Credit Ranges

Lenders consider credit scores when assessing loan applications. Generally, the higher your credit score, the lower the risk you pose as a borrower, and the more favorable loan terms you are likely to receive. Lenders may offer borrowers with excellent credit scores lower interest rates, higher credit limits, and more flexible repayment terms. On the other hand, borrowers with poorer credit scores may face higher interest rates, stricter loan terms, or even be denied credit altogether.

Where to Find Your Credit Score

Obtaining Your Free Credit Report

To find your credit score, you can start by obtaining your free credit report from any of the three major credit bureaus: Equifax, Experian, and TransUnion. By law, every individual is entitled to one free credit report per year from each bureau. You can request your reports either online, by phone, or by mail. Reviewing your credit report will give you insight into the factors affecting your credit score and allow you to identify any discrepancies or errors.

Credit Bureaus (Equifax, Experian, TransUnion)

The three major credit bureaus, Equifax, Experian, and TransUnion, are responsible for collecting and maintaining consumer credit information. These bureaus gather data from various sources, such as lenders, creditors, and public records, and compile it into credit reports. Your credit score is based on the information contained in these reports. It’s crucial to ensure the accuracy of the information on your credit reports, as errors can negatively impact your credit score.

Understanding Your Credit Report

Your credit report provides a detailed overview of your credit history, including your payment history, credit accounts, and any negative information such as late payments, collections, or bankruptcies. It’s essential to review your credit report regularly to ensure that all the information is accurate and up to date. Any errors should be disputed with the respective credit bureau to have them corrected.

Monitoring Your Credit Score

Why Regular Monitoring Is Essential

Monitoring your credit score regularly is essential for several reasons. Firstly, it allows you to keep track of your credit health and ensure that your credit score remains within the desired range. Regular monitoring also helps you detect any suspicious activity or signs of identity theft, which can be addressed promptly to minimize further damage. Additionally, monitoring your credit score enables you to identify any negative changes and take appropriate actions to improve your credit standing.

The Role of Financial Coaches in Credit Monitoring

Working with a financial coach can be immensely beneficial when it comes to credit monitoring. These professionals have expertise in personal finance and can provide guidance on maintaining a good credit score. They can help you understand the various factors that affect your credit standing and suggest strategies to improve your creditworthiness. Financial coaches can also assist in analyzing your credit reports, identifying areas for improvement, and developing a personalized plan to achieve your financial goals.

Setting Up Credit Score Alerts

Many credit monitoring services offer credit score alerts, which can be a useful tool for staying informed about any changes to your credit score. These alerts notify you of any significant changes, such as a drop in your credit score or a new account being opened in your name. By promptly responding to these alerts, you can take the necessary steps to protect your credit and prevent any potential harm.

Conclusion

In conclusion, credit scores play a crucial role in our financial lives. Understanding credit scores, their impact on financial opportunities, and their role in borrowing rates is essential for making informed financial decisions. By knowing your credit score, reviewing your credit report, and monitoring your credit regularly, you can take the necessary steps to maintain or improve your credit standing. Remember, your credit score is not set in stone, and with thoughtful financial management, you can work towards achieving an excellent credit score. So, start taking charge of your credit health and unlock the many financial opportunities that await!

The Link Between Credit Scores and Financial Health

Your credit score is a vital component of your overall financial health. It affects your ability to secure loans, obtain credit cards, and even rent an apartment. By understanding credit scores and actively managing yours, you can improve your chances of achieving financial success. Remember, a good credit score opens doors to better financial opportunities and can save you money in the long run.

Teaser for Upcoming Blogs in the Series

In our upcoming blogs, we will dive deeper into specific topics related to credit scores. Stay tuned as we explore strategies to improve your credit score, ways to manage debt effectively, and tips for building a strong credit history. Don’t miss out on the valuable insights and practical advice that will help you take control of your financial future. Keep following our series to stay informed and empowered!

Discover more in Part 2-The Role of Financial Coaches in Credit Improvement of our series.